Get Your Refund Faster with a Secure Australian Online Tax Return Filing Choice

Get Your Refund Faster with a Secure Australian Online Tax Return Filing Choice

Blog Article

Explore How the Online Income Tax Return Refine Can Streamline Your Tax Obligation Declaring

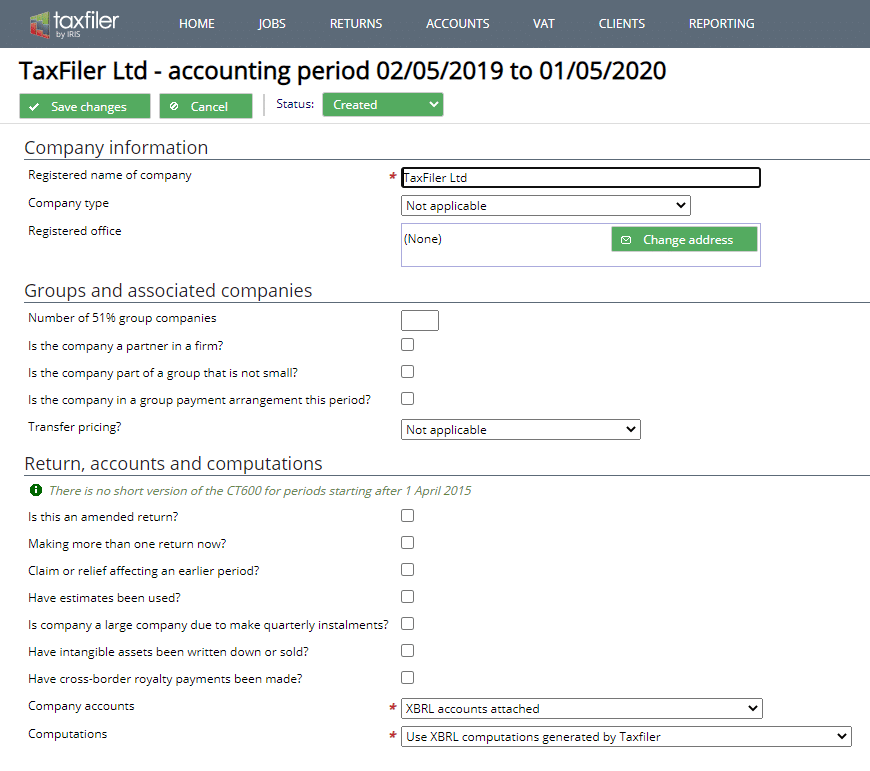

The on-line tax return procedure has actually transformed the way people approach their tax filings, supplying a level of ease that traditional methods typically lack. By leveraging straightforward software application, taxpayers can navigate the intricacies of tax obligation prep work from the convenience of their homes, dramatically decreasing the time and effort entailed.

Advantages of Online Tax Filing

The advantages of on-line tax filing are significant and numerous for taxpayers seeking efficiency and accuracy. One primary advantage is the benefit it uses, allowing people to finish their tax obligation returns from the comfort of their very own homes any time. This gets rid of the requirement for physical journeys to tax obligation workplaces or waiting in long lines, hence conserving important time.

:max_bytes(150000):strip_icc()/IRSDirectFile-ca42f3f059c7448f96e19187e4107d7a.jpg)

An additional prominent benefit is the rate of processing; electronic entries normally lead to quicker refunds contrasted to traditional paper filings. Taxpayers can additionally gain from enhanced security actions that secure sensitive individual details during the declaring process.

In addition, online filing systems usually provide access to numerous resources, including tax obligation suggestions and Frequently asked questions, empowering taxpayers to make educated choices. Australian Online Tax Return. On the whole, these benefits contribute to a streamlined declaring experience, making on-line tax obligation filing a preferred option for lots of people and organizations alike

Step-by-Step Filing Process

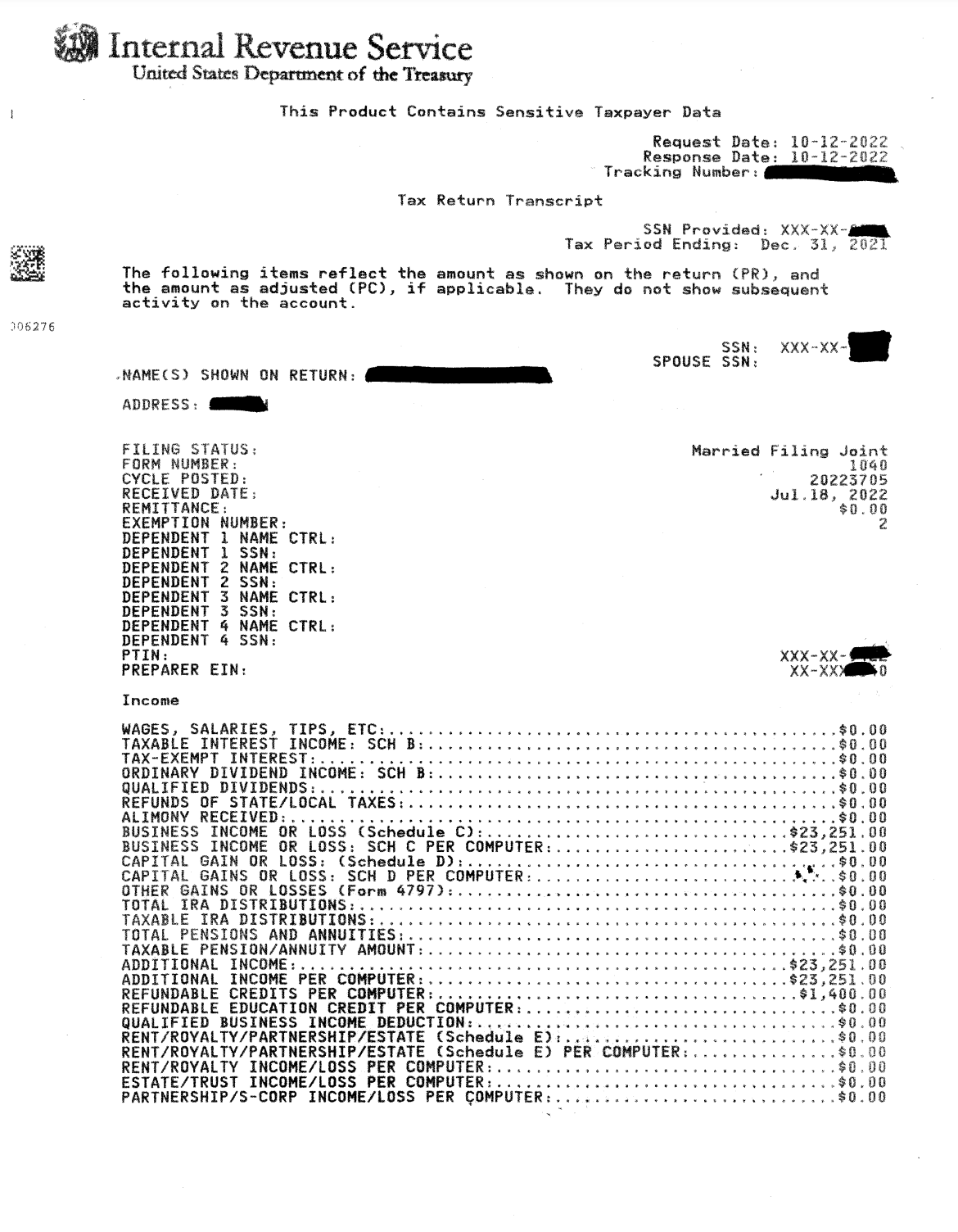

To successfully browse the online income tax return process, taxpayers can follow a simple, step-by-step technique. Initially, people must collect all needed documentation, consisting of W-2 kinds, 1099s, and invoices for reductions. This prep work ensures that all relevant financial details is conveniently offered.

Next, taxpayers need to select a respectable on the internet tax software application or platform. Numerous options exist, so it is essential to choose one that fits individual requirements, including individual experience and the complexity of the tax scenario. As soon as the software application is chosen, individuals should create an account and input their individual details, such as Social Security numbers and declaring condition.

The adhering to action includes entering revenue information and any type of applicable reductions and credit histories. Taxpayers must thoroughly follow motivates to make sure accuracy. After finishing these sections, it is important to review the details for errors or noninclusions. A lot of platforms supply an evaluation feature that highlights possible issues.

Usual Features of Tax Obligation Software Application

Tax software application commonly incorporates a variety of functions designed to enhance the declaring process and boost customer experience. Among the most notable functions is straightforward interfaces that lead taxpayers through each action, making certain that even those with minimal tax obligation knowledge can browse the intricacies of tax preparation.

In addition, numerous tax obligation software program programs offer automated data access, allowing users to import economic info straight from numerous sources, such as W-2 types and financial institution declarations, which significantly minimizes the opportunities of mistakes. Some platforms also supply real-time error monitoring, alerting users to prospective errors prior to entry.

In addition, tax software typically includes tax calculators that help approximate potential reimbursements or obligations, allowing individuals to make enlightened choices throughout the declaring procedure. Several applications also feature robust tax deduction and credit score finders that assess customer inputs to recognize applicable tax advantages, maximizing potential savings.

Safety and Privacy Procedures

Making sure the safety and privacy of sensitive financial information is paramount in the on-line tax obligation return procedure. Tax preparation solutions utilize advanced security protocols to secure information during transmission. This file encryption guarantees that individual details remains hard to reach to unapproved celebrations, substantially decreasing the threat of information breaches.

Moreover, reliable tax obligation software program suppliers execute multi-factor authentication (MFA) as an included layer of safety and security. MFA calls for individuals to verify their identification through several channels, such as a text message or e-mail, before accessing their accounts. This measure not just enhances security however also aids in stopping unapproved access.

In addition, numerous systems site link adhere to market requirements and laws, such as the Repayment Card Industry Data Safety Standard (PCI DSS) and the General Information Protection Guideline (GDPR) Compliance with these guidelines ensures that individual information is dealt with sensibly and reduces the threat of misuse. - Australian Online Tax Return

Normal security audits and susceptability analyses are executed by these platforms to recognize and resolve prospective weaknesses. By incorporating these security procedures, the on-line income tax return procedure cultivates a protected atmosphere, permitting users to file their tax obligations with self-confidence, knowing that their sensitive details is protected.

Tips for a Smooth Experience

Preserving safety and personal privacy during the on the internet income tax return try this web-site procedure lays the structure for a smooth experience. To achieve this, start by choosing a trustworthy tax software application or solution copyright that uses strong encryption and data security procedures. Make certain that the picked platform is compliant with internal revenue service regulations and supplies safe and secure login options.

Organize your files in advance to reduce anxiety throughout the declaring procedure. Gather W-2s, 1099s, and any kind of various other pertinent tax obligation papers, categorizing them for simple gain access to. Australian Online Tax Return. This prep work not just quickens the procedure yet additionally lowers the likelihood of missing essential information

Furthermore, make the effort to verify all entrances before submission. Errors can lead to hold-ups and possible audits, so a comprehensive evaluation is paramount. Make use of integrated error-checking devices provided by numerous tax software programs, as these can capture usual errors.

Finally, submit your tax return as very early as possible. Early filing permits even more time for any type of required corrections and may quicken your reimbursement. Complying with these pointers will help make certain a smooth and effective on the internet tax return experience, ultimately simplifying your tax declaring journey.

Verdict

The on-line tax obligation return process has transformed the means people approach their tax obligation filings, using a degree of comfort that standard approaches commonly lack.The advantages of on-line tax obligation declaring are many and significant for redirected here taxpayers looking for performance and precision. Adhering to these ideas will aid make sure a seamless and efficient online tax obligation return experience, ultimately simplifying your tax obligation filing journey.

In verdict, the on the internet tax return procedure provides substantial benefits that streamline the tax obligation filing experience. By leveraging the advantages of on the internet tax obligation filing, people can maximize their potential financial savings while lessening the tension typically linked with conventional declaring methods.

Report this page